News Biotechnology market

Biotechnology market

Curing complex diseases, improving the quality of life, extending it – this is what biotechnology can provide in the future. The industry is attracting more and more attention not only by the opportunity to make money on the growth of the asset's value but also by the personal interest of investors to take advantage of its achievements.

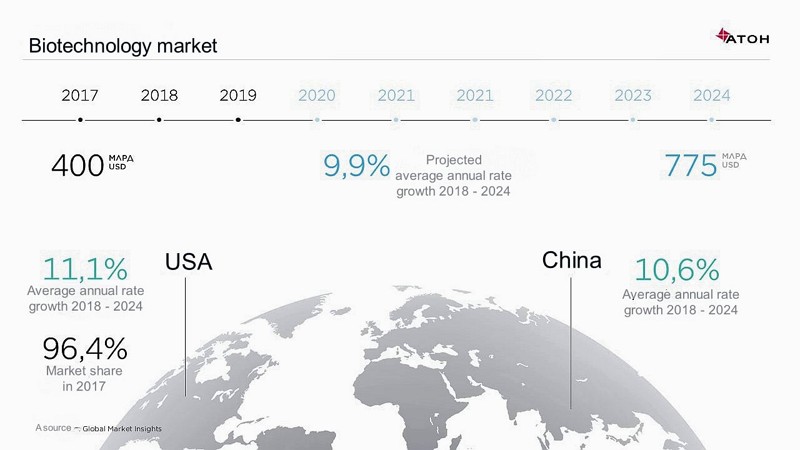

The volume of the global biotechnology market will reach $775.2 billion by 2024, as the US agency Global Market Research predicts. According to analysts, it will grow by an average of 9.9% per year. For comparison, back in 2017 the market volume was at the level of $399.4 billion, and in 2015 it was $330.36 billion.

There are three main reasons for the attractiveness of investments in the biotechnology and medicine market, says Stanislav Denisov, founder of the HBio Capital Management biotech fund, registered in Switzerland. First, this market is based on the core value – human life, it will grow and develop at the same exponential rate as the growth of the planet's population and health care costs.

The next reason is the high speed with which an individual company in this market comes to its “fair value”: the investor does not have to wait for a long revaluation of the company by the market, this happens at the time of the publication of new clinical data. Accordingly, an investor or trader who made a correct forecast “takes away” excess returns in a very short period of time (however, this also works in the opposite direction).

And one more reason for the attractiveness is the absence of a noticeable correlation between the dynamics of stock quotes of an individual company in relation to the general market, so shares from this sector can be used to effectively diversify the investment portfolio.

Official resources: